It is noted that the Russian currency has already lost a quarter of its value since August.

Russian ruble

weakened further against the dollar and the Chinese yuan on Wednesday. The currency has fallen by more than 24% since the beginning of August.

Edition Reuters writes that the ruble fell by 0.86% to 106.40 against the dollar. The yuan fell 0.51% to 14.74, also its lowest level since March 2022.

The ruble’s slide is compounded by a more than 20% fall in the stock market this year, as investors move their savings out of stocks and into deposits, which offer interest rates higher than the central bank’s 21% base rate.

The falling ruble is fueling inflation that will exceed the central bank’s forecasts for this year, which runs counter to the regulator’s painful tightening of monetary policy, with the key interest rate at its highest level since 2003.

The Central Bank estimates that a 10% weakening of the ruble adds 0.5 percentage points to inflation, meaning that a four-month fall in the ruble could add 1.5 percentage points to the current inflation rate.

Central Bank and different analysts:

“For the central bank, this is a challenge in the fight against rising prices,” said economist Yevhen Kogan.

Many analysts predicted that the ruble could reach 115-120 by the end of the year, and some called on the government and the central bank to take measures, for example, to force exporters to sell more currency and to reduce purchases of currency by the state.

The fall in the ruble was exacerbated by new sanctions on Russia’s financial sector, which disrupted foreign trade payments, especially for oil and gas, creating a physical shortage of the currency in the Russian market, analysts said.

Most of the big Russian banks are currently under US sanctions and therefore cannot conduct banking transactions in dollars, and their only option for currency trading is to import large amounts of cash dollars.

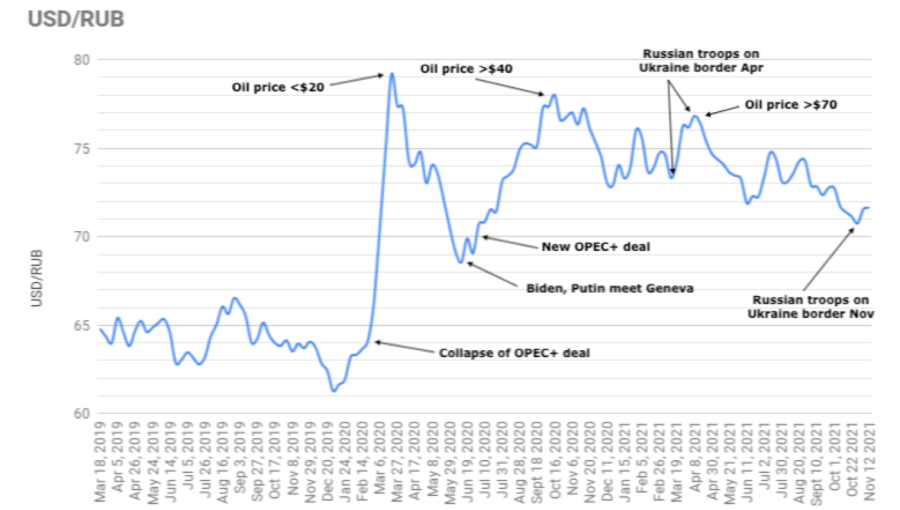

Many analysts stressed that, apart from a new round of tensions with the West over Russia’s war against Ukraine and new financial sanctions, there were no fundamental reasons for the drop, and prices for oil, Russia’s main export, were generally stable.

According to Finance Minister Anton Siluanov, a weak ruble is beneficial to exporting companies, as prices for Russian energy carriers are mainly set in dollars. It also helps the Russian government to increase budget revenues from energy taxes and export duties.

“The main reason for such a significant weakening is that, in our opinion, this weakening is desirable,” says Mykola Dudchenko, an analyst at the Finam brokerage company. “Today, the exchange rate greatly contributes to balancing the budget,” he added.

The ruble exchange rate – the latest news:

June 12 The Moscow Stock Exchange was included in the “black lists” of the US Treasury. The next day, trading in the US dollar, euro and Hong Kong dollar stopped on the exchange, and the Central Bank began to set official exchange rates based on OTC agreements.

The ruble rate reached the “red line” of 100 rubles for one US dollar after the introduction of new sanctions.

By 24Webs.com