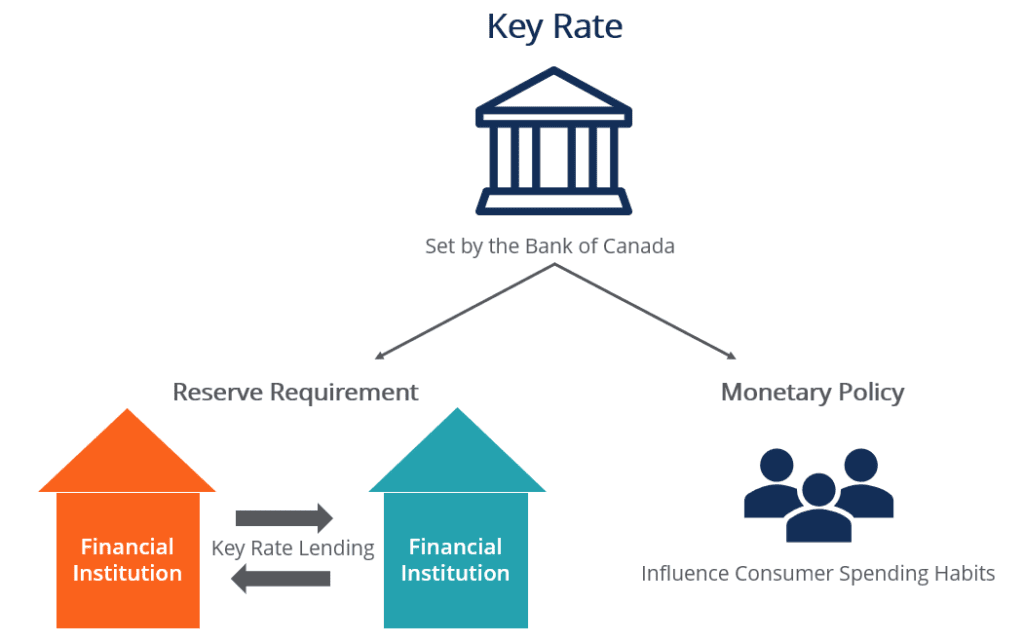

What is the Central Bank key rate:

Key rate – an instrument of the country’s monetary policy. This is the percentage at which the Central Bank of Russia (CBRF) issues short-term loans to commercial banks and accepts money from them for short-term deposits.

The Central Bank is responsible for monetary policy, which is based on inflation targeting. He also makes the decision to increase, decrease or maintain the key rate at the same level.

The regulator seeks to manage inflation and prevent it from deviating from the specified indicators. Currently, the optimal inflation rate for the further development of the Russian economy is 4%. It should remain the same in 2024, the Central Bank of the Russian Federation expects.

When inflation accelerates, the Central Bank decides to raise the key rate. Following this, interest rates on loans, as well as on deposit accounts, rise. People begin to spend less and save more, demand for goods decreases, and it becomes more difficult to raise prices. As a result, in an ideal scenario, inflation slows down.

What do high and low key rates mean for citizens?

High rate.

- Money in the economy becomes more expensive.

- Interest rates on loans are rising.

- Interest rates on deposits – deposits and savings accounts – are increasing.

- Purchasing power is decreasing.

- The pace of development of the country’s economy is slowing down.

- The ruble is strengthening.

- Inflation is slowing down.

At a high rate, a situation arises where people save more but spend less. For example, if a person has enough savings, he can increase them by placing them in a deposit or account with a higher rate – banks are quite quick to issue such products following a rate increase. On the other hand, citizens will be wary of large loans and mortgages with high interest rates – in banks they are higher than the key rate.

Apparently, we will have to live with a high key rate for some time. Earlier, in a conversation with FederalPress, experts expressed cautious assumptions that the double-digit rate could remain in the future. next two years.

Low rate:

- Money is getting cheaper.

- Interest rates on loans are falling.

- Interest rates on deposits and savings accounts are also becoming lower.

- Purchasing power is being restored.

- The development of production is accelerating.

- The ruble is weakening.

- Inflation may begin to accelerate again.

Following the reduction in the rate of the Central Bank of the Russian Federation, banks are reducing interest rates on deposits. In this situation, people begin to spend more again and are not afraid to take out loans. In the period after a key rate reduction, people usually try to buy something impressive and valuable – cars, expensive household appliances, real estate. Savers who have savings pay less attention to bank deposits and are looking at other sources of income, such as stock markets.

Let us note that in 2023, against the backdrop of rising inflation, the Central Bank of the Russian Federation made several statements about increasing the key rate: at the beginning of the year it was at the level of 7.5% per annum, in December – 16%. In 2024, growth continued. From October 2024 key rate is at the level of 21%.

We also recommend reading how save and save, while the ruble and the market are in a fever.

By 24Webs