Aggressive economic measures:

With Donald Trump returning to the White House, markets are predicting that China may introduce more aggressive economic stimulus measures, strengthen its manufacturing industry and tolerate a depreciation of the yuan in order to counteract the negative impact on its economy. Those involved are watching.

Fifteen of the 19 economists surveyed by Bloomberg News after last week’s U.S. presidential election said these measures would affect the impact of Trump’s policies on China’s economic growth rate over the next four years of the second Trump administration. They answered that it is possible to keep the average percentage point below 1 point each year.

Three people predicted that the gross domestic product (GDP) growth rate would be pushed down by 1-2 percentage points, but one person said there would be no major impact.

Dennis Shen, primary China economist at Scope Ratings, said: “The incoming Trump administration will likely slow China’s growth, but that decline will be partially offset by budgetary and monetary stimulus.” ” I predicted.

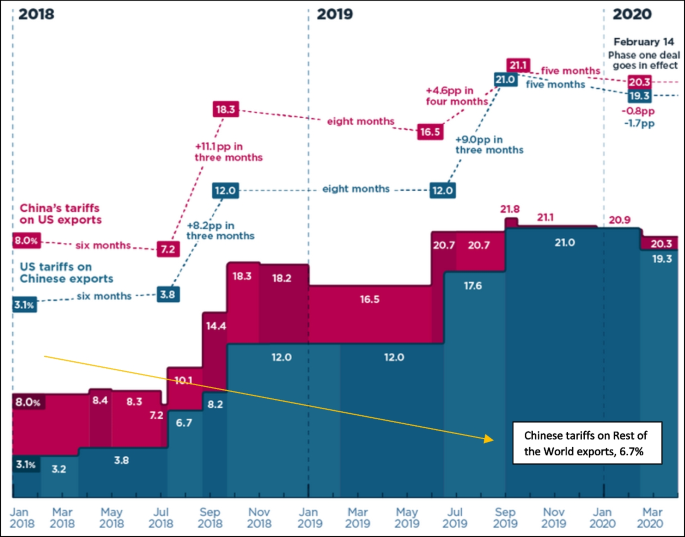

Mr. Trump has indicated that he will impose 60% tariffs on Chinese products, which would deal a devastating blow to U.S.-China trade and inevitably impact exports, which have been one of the few bright spots for China this year.

The Chinese government’s efforts to stabilize an economy hit by years of slump in the real estate market and persistent deflationary pressures are likely to become even more difficult.

fiscal stimulus:

Meanwhile, as the possibility of an escalating trade war increases, expectations are also rising that Chinese authorities will take more aggressive economic stimulus measures to stimulate domestic demand to compensate for the decline in exports.

The fiscal package announced on Wednesday disappointed investors who had hoped for more direct measures to stimulate consumption, but Finance Minister Lai Fo-an hinted that bolder measures could be adopted next year.

An overwhelming majority of economists said they would allow China to significantly expand its fiscal deficit following Trump’s return to power. This was the most common response among the policy options presented in the survey.

The next most popular factors were monetary easing, strengthening housing support measures, and expanding investment in advanced manufacturing. Very few respondents answered that it would be a direct cash transfer.

currency devaluation

More than half of respondents said that China may decide to weaken the yuan, which would make Chinese exports more competitive and help offset some of the potential tariffs.

However, opinions differed greatly on the extent of such currency devaluation, and the outlook for the yuan’s exchange rate in 2025 varied between 7.3 and 8 yuan to the dollar.

Some economists, such as ANZ Bank’s Yang Yulin, analyze that China wants stability rather than a competition to devalue its currency. China has seen an increase in foreign direct investment since at least 1990, but this yearnet outflowThere is a possibility that it will turn into A weaker yuan encourages capital outflow.

Revenge:

Respondents’ opinions were not so clear as to whether China might deal a blow to the US side in retaliation for its tariff measures.

A majority of respondents cited agricultural products as the item most likely to be subject to retaliatory tariffs.

Soybeans are the most likely target, followed by beef, corn and automobiles. Some respondents believed that exports of rare earths and electric vehicle (EV) batteries may be restricted.

Some economists assume that Chinese manufacturers are likely to increase investment in overseas production sites to avoid U.S. tariffs.

However, some sources warn that if Chinese export companies try to increase shipments outside the U.S. to make up for losses in the U.S. market, they may face a backlash from those countries as well. If that happens, China could sow the seeds of an escalating trade war on many fronts.

“This will spark a backlash among trading partners, who will seek to protect domestic industries from increased imports from China,” said Julian Evans-Pritchard, head of China economics at Capital Economics. .

By 24Webs.